Institutions are mandated by law to implement safeguards against Tax Evasion, Accounting-Fraud, Bribery, Corruption, Money Laundering and Financing of Terrorism.

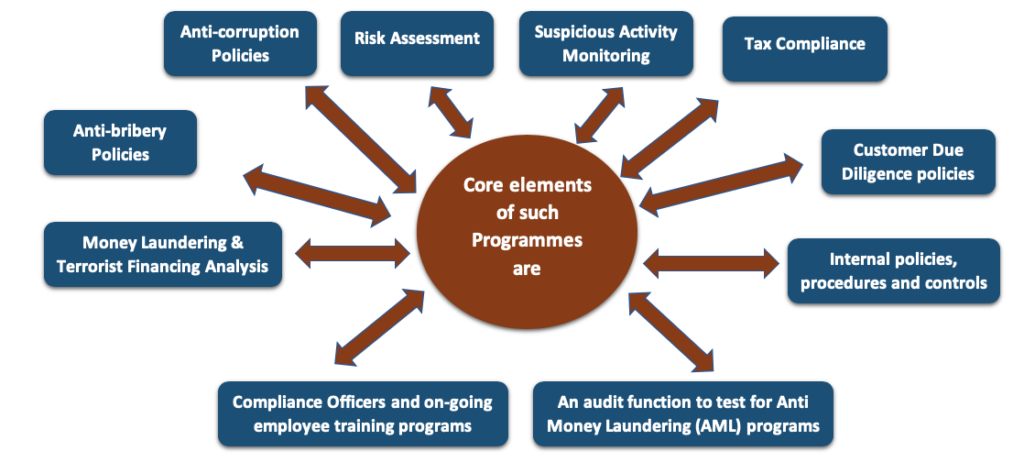

We provide programmes to ensure organizational compliance with regulatory and supervisory authorities for financial institutions (FI’s), designated non-financial businesses and professions (DNFBPs), capital market operators, insurance companies and other industry-related players.

The primary goal of the programme is to mitigate the risks and to ensure full compliance with relevant laws and regulations to avoid sanctions and reputational damage. We design, structure and assist companies to implement programs using a risk-based approach.